The smart Trick of Worker's Compensation That Nobody is Talking About

Wiki Article

Worker's Compensation Can Be Fun For Anyone

Table of ContentsTop Guidelines Of Worker's CompensationWorker's Compensation Can Be Fun For AnyoneSome Known Factual Statements About Worker's Compensation 6 Simple Techniques For Worker's CompensationFascination About Worker's Compensation

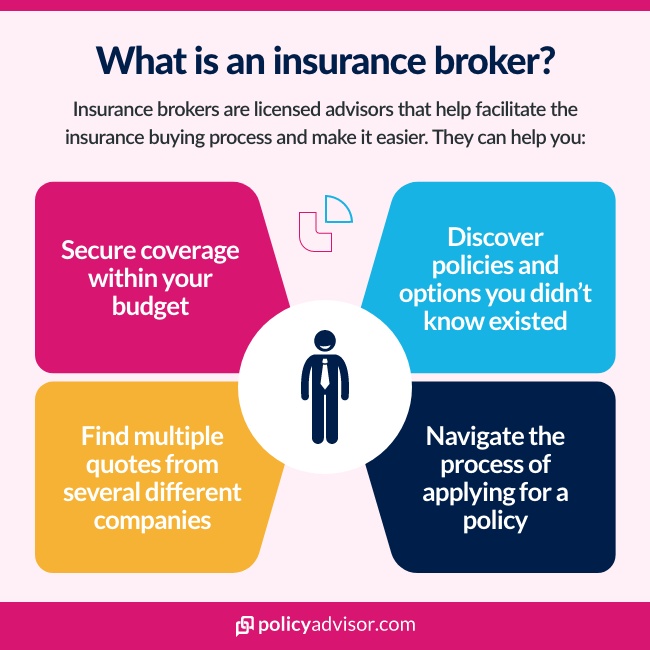

They're additionally experienced in locating you a plan that uses stable prices as well as an insurance provider that has a proven track document. A broker has no incentive to sell you a "one-size-fits-all" policy that may not be the very best suitable for your demands. Rather, your broker will certainly deal with you to discover the best policy for your budget plan while making certain that you have ample insurance coverage.

In some cases, having a high insurance deductible is a good method, yet in other circumstances, it's not the best means to go. Is it worth paying higher costs to expand your insurance coverage? An insurance coverage broker can explain the reasoning behind the selections you have to make as well as assist you in making the right decision.

A broker does not represent simply one firm and also has no incentive to steer you in a particular instructions when it pertains to purchasing a plan. In order to maintain you as a customer, your broker wants you to be satisfied with the terms of your insurance coverage policy. That's why a great broker will certainly ensure that you're upgraded regarding plan adjustments and new offerings that could save you cash or boost your coverage.

Worker's Compensation for Beginners

territories, has an insurance coverage payment that certifies the insurance coverage agents and also insurer who do business in that territory. State insurance compensations additionally enforce sales and also advertising regulations and also require business to file economic records to analyze their capacity to recognize claims. You can call your state insurance commissioner by visiting the website of the National Association of Insurance Coverage Commissioners (NAIC) at .If an insurance coverage representative uses products that are thought about securitiessuch as variable annuity contracts or variable life insurance policy policiesthe agent have to likewise be accredited as a registered representative and also conform with FINRA rules. Insurance policy agents defined as "captive" work specifically for one insurer as well as can market only the policies and also products that business provides.

is an individual who is accredited to sell insurance coverage and commonly collaborates with several insurance provider providing a selection of products to a consumer. Worker's Compensation. Instead of an insurance representative, who offers the products of only one business, an insurance coverage broker has the ability to compare various items of the firms he/she collaborate with and therefore is often seen as a much more consumer-friendly choice.

When functioning with an insurance policy broker, it is important to understand how numerous different carriers a broker works with as well as the insurance coverage items he/she can use. Comparable instance with a life insurance policy broker.

The Best Guide To Worker's Compensation

Life insurance broker can navigate through them and also usually obtain reduced rate than you would jump on your very own (e. g. due to the fact that brokers might have some air to offer price cuts on insurance coverage products as a result of the large insurance quantities they make). An insurance policy broker is someone that benefits the plan proprietor.What I imply by independent is that he or she locates the plan that is finest for you. After determining your requirements, as an example, a $350,000 term 25 plan, which would imply the premiums are degree for 25 years, your broker would certainly then look the marketplace to locate you the very finest deal.

If you have look at more info any type of health and wellness problems, he might identify which insurer is best for that particular health problem by talking with the numerous experts. Our Publications pertaining to Life Insurance coverage October 25th, 2021 Introduction There were many articles discussed men paying more for automobile insurance coverage than ladies, yet what concerning various other insurance coverage types? Do women constantly take advantage of lower insurance rates? We tackled this inquiry and also methodically experienced various life insurance policy, special needs insurance policy, and also critical illness insurance policy by seeking advice from with specialists who had the answers. [] March 16th, 2021 The arrival of COVID-19 has pushed Canadians, even more than ever in the past, online for searching for and also using for insurance policy and also financial items.

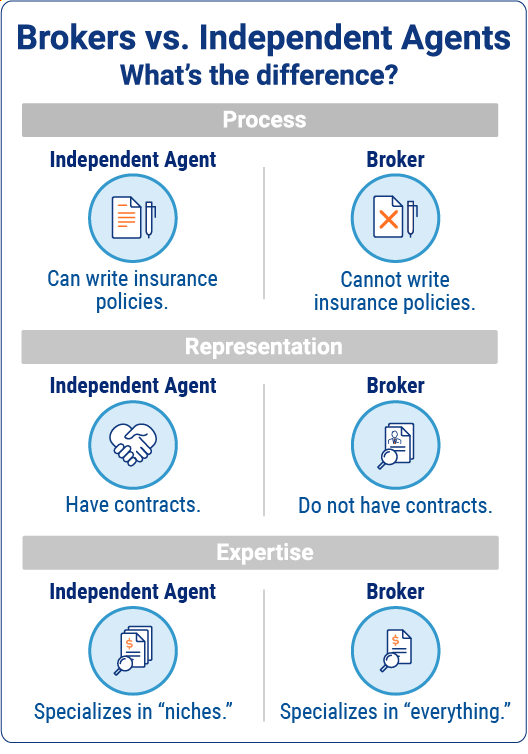

Insurance policy representatives, insurance coverage producers, and also all play vital duties in making the insurance coverage market work. What do insurance policy representatives do that insurance coverage brokers do not?

The Main Principles Of Worker's Compensation

Insurance coverage representatives can either be "captive" agents (implying the business they stand for forbids them from selling insurance coverage from any kind of various other firm) or independent representatives (that stand for even more than one firm, and also are consequently able to market insurance from multiple carriers). The most important distinction between a representative and a broker is that insurance agents benefit the insurance provider; they More Help market items that the insurance firm is accredited to market in their state.

Despite the difference in names, the duty they play is specifically the very same. Whether someone is called an insurance manufacturer or an insurance policy agent, it is their work to market insurance protection on behalf of an insurer. Unlike the distinction in between insurance policy agents and, the difference between agent as well as manufacturer is simply making use of a various title for the very same task.

Unlike insurance policy agents, brokers are not agents employed by insurance coverage providers to represent them. Instead, brokers deal with part of their customers (private consumers). When a consumer hires an insurance policy broker, the broker will certainly undergo the lots of offered strategies as well as determine the one that best fits their consumer's demands.

While the distinctions between representative, broker, and producer might seem unimportant, comprehending what makes them various can help consumers have a simpler time functioning their method through the system and also obtaining coverage. One more important factor to recognize the distinction is that, relying on the state, the licensing needs for every task can be slightly various.

Worker's Compensation for Dummies

If you're seeking a profession in the insurance policy area, it's critical to understand the differences between a broker and an agent so that you go to my blog can be sure to get the appropriate certificate for whichever placement you are pursuing. If you would like to know more regarding insurance agents, brokers, as well as insurance policy licensing needs, contact America's Professor today to sign up in one of our on-line insurance examination preparation courses.

Report this wiki page